How will the stock market open on Wednesday - June 24, 2009? The Dow Jones and Stock Market Futures are pointing toward a higher open for pre market. Check out technical analysis for June 24.

Discuss Stocks - www.stockstobuy.org

Stock Market Futures 6/24/09 - Pre Market Trading - Updated 8:50am EST

Durable Goods - Futures Soaring!

Dow Jones Futures - Up 65

S&P 500 Futures - Up 8

Nasdaq Futures - Up 11

Nikkei - 9590.32 Up 40.71

Oil Futures - 69.00

Gold Futures - 930

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - Baltic Dry Index

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Hot Stock Alerts

Potential Breakout Stocks of the Day:

Tuesday, June 23, 2009

Dow Jones Analysis 6/24/09 Stock Market Analysis

Dow Jones Chart - The following is Technical Analysis for the Dow Jones ( DJIA ) for 6/24/09

Dow Jones Chart - The following is Technical Analysis for the Dow Jones ( DJIA ) for 6/24/09Dow Jones Industrial Average ($DJI) Support & Resistance Levels - June 24, 2009

Resistance Levels: 8383, 8533, 8700

Support Levels: 8250, 8000

http://stockcharts.com/ - Chart

The Dow Jones Industrial Average closed below the 50 day moving average for the second straight day but managed to hold the 8250 support level. If the Dow closes below 8250 I feel it will retest 8000 or below. If things get much worse from here, the 10 day moving average could break down below the 50 day moving average which would cause a Dow sell signal. 8600 now becomes strong resistance. For More Technical Analysis - Go Here

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - Baltic Dry Index - Stock Forum

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Dow Jones Close 6/23/09 - Stock Market Closing Prices

Stock Market Closing Prices - 6/23/09

Dow Jones Industrial Average ( DJIA ) Close - 8322.91 Down 16.10

Nasdaq Stock Market Close - 1764.92 Down 1.27

S&P 500 Close - 895.10 Up 2.06

http://dowjonesclose.com

Libor Rates - 6/23/09 - Mortgage Rates

Commodities Closing Prices - 6/23/09

Gold - 925.70

Oil - 69.33

Natural Gas - 3.89

Discuss Stocks - www.stockstobuy.org

The Dow Jones Industrial Average closed at 8323 on 6/23/09, as the stock market was mixed as we await the fed rate decision on Wednesday. The Dow Jones Futures started the day higher but closed at the lows going into the open after Boeing Co. (BA) announced that it would be delaying the dream liner test again. Shares of Dow component were immediately sold off which gave the Dow Jones trouble during the trading.

Commodities rebounded with Oil trading near $70 once again. That pullback didn't last long! A treasury auction was well received in the afternoon but the stock market failed to rally. Why? There are a few more this week and all eyes will be glued to the Fed statement due out tomorrow afternoon. The Federal Reserve is expected to keep rates at zero but investors and traders will be paging through the statement as soon as it is released for any new information on the economy. Check out some of the events I will be watching for Wednesday.

Also, Check out my stocks to watch report for Wednesday. I will also have technical analysis of the stock market tonight - Right Here

Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - Baltic Dry Index

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Dow Jones Industrial Average ( DJIA ) Close - 8322.91 Down 16.10

Nasdaq Stock Market Close - 1764.92 Down 1.27

S&P 500 Close - 895.10 Up 2.06

http://dowjonesclose.com

Libor Rates - 6/23/09 - Mortgage Rates

Commodities Closing Prices - 6/23/09

Gold - 925.70

Oil - 69.33

Natural Gas - 3.89

Discuss Stocks - www.stockstobuy.org

The Dow Jones Industrial Average closed at 8323 on 6/23/09, as the stock market was mixed as we await the fed rate decision on Wednesday. The Dow Jones Futures started the day higher but closed at the lows going into the open after Boeing Co. (BA) announced that it would be delaying the dream liner test again. Shares of Dow component were immediately sold off which gave the Dow Jones trouble during the trading.

Commodities rebounded with Oil trading near $70 once again. That pullback didn't last long! A treasury auction was well received in the afternoon but the stock market failed to rally. Why? There are a few more this week and all eyes will be glued to the Fed statement due out tomorrow afternoon. The Federal Reserve is expected to keep rates at zero but investors and traders will be paging through the statement as soon as it is released for any new information on the economy. Check out some of the events I will be watching for Wednesday.

Also, Check out my stocks to watch report for Wednesday. I will also have technical analysis of the stock market tonight - Right Here

Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - Baltic Dry Index

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Stocks to Buy June 24, 2009 6/24/09

Tuesday, during regular trading hours, there were many stocks that continued to break out to the upside. Below is a list of stocks that are worth watching for June 24, 2009. Also, check out the Biggest Stock Gainers of the Day. You can also find previous stocks to buy reports - Right Here

Discuss Stocks - www.stockstobuy.org

Stocks to Watch - 6/24/09 - Stock Market Ideas

Direxion Daily Financial Bear 3X Shares (FAZ)

Daily Finan. Bull 3X Shs(ETF)(FAS) - FAS stock broke $8 on Tuesday morning and quickly snapped back hard into the $8.40's in the afternoon hours. There is a lot of resistance in the $8.40's from Monday afternoon and Tuesday. When FAS break above $8.50 I think it could make an attempt to retest $9. I continue to buy the huge dips and sell the 4-6% bounce back rips higher. Banks will start reporting earnings in about three weeks and I expect some better then expected earnings reports due the borrowing at zero factor. As for FAZ, if FAS can get back near $10, I would be buying FAZ for a trade.

Citigroup Inc (C:NYSE) - Citigroup stock broke down through $3 on Tuesday for the first time since the start of May 2009. $2.90 ended up being the low before the snap back rally back to $3. This could have been the capitulation selling investors were looking for and C stock could be gearing up for a run back to $3.25-$3.50 before earnings. If I were buying Citigroup here, i'd be placing a stop loss order at $2.89.

Bank of America Corp ( BAC ) - Bank of America Corporation was very strong on Tuesday and traded back above $12 for most of the day. BAC has strong support at the 50 day moving average around $11.16 but a close below this would be the first sign of severe weakness. The stock has resistance at $12.75 ( 10 day moving average ) and $13.84 ( 200 day moving average ).

Wells Fargo & Company (NYSE:WFC) - Wells Fargo stock traded near Guy Adami's $22 price target on Tuesday and quickly bounced back up to $23. I am expecting another great earnings quarter out of WFC in the coming month. In my opinion, anything below $22 is a strong buy.

Potash Corp. of Saskatchewan (NYSE: POT) , Mosaic Co. (MOS) - POT and MOS snapped back Tuesday after a huge pullback as reports of weakening Potash demand were released last week. POT stock could be headed back to the $98-$100 resistance area in the short term which I would then sell. The 10 day moving average is getting ready to break down through the 50 day moving average....this is a bearish signal. If POT would retrace to the $80 support level, I will be buying!

Research In Motion Ltd. (RIMM) - RIMM was strong on Tuesday and traded back above $70 once again. The low was $67.53 so this is where i'd be putting my stop loss order if I were trading RIMM stock. I am neutral right now on shares of RIMM at $70, i'd be a buyer below $60, a seller in the $80's.

Ford Motor Company (F) - Ford traded down to $5.21 on Tuesday, almost near my buy price of $5. Each time we get these big dips, Ford stock always snaps back....very bullish. If the stock market rolls over one more time in the next few weeks I think you will be able to pick up shares around $5. This is what I am waiting for right now.

Hemispherx Biopharma, Inc. (HEB) - Shares of HEB were crushed on Tuesday morning as another big investor sold shares. The lack of an FDA decision or company press release explaining the situation has really unnerved investors who are holding the shares. Keep in mind, HEB stock is still up 100% from when all of this started back in May. I continue to have no position in the stock but am eagerly awaiting the FDA decision on Ampligen. If you are trading HEB, a break above $2.15 would probably get the stock moving higher again and you might be able to get $2.50 out of it in the short term.

Buy the Dip - Below is a list of stocks I would be buying on any strong pullback.

Visa Inc. (NYSE: V)

MasterCard (MA)

Apple (AAPL)

First Solar (FSLR)

McDonald's Corporation (MCD)

Continental Resources Inc. (CLR)

Hess Corp ( HES )

Freeport-McMoRan Copper & Gold Inc. (FCX)

Pyramid Oil Company ( PDO )

AgFeed Industries ( FEED )

Fuel Systems Solutions, Inc. (FSYS)

STEC, Inc. (STEC)

Huntington Bancshares Inc. (HBAN)

Other Stocks to Watch - June 24, 2009

Agilysys Inc. (AGYS)

Republic Airways Holdings Inc. (RJET)

La-Z-Boy Inc. (LZB)

GreenHunter Energy, Inc. (GRH)

America's Car-Mart Inc. (CRMT)

Lloyds Banking Group plc (LYG)

Hudson Highland Group Inc. (HHGP)

CB Richard Ellis Group, Inc. (CBG)

Navios Maritime Holdings Inc. (NM)

SIGA Technologies Inc. (SIGA)

Owens Corning (OC)

Penny Stocks to Watch - 6/24/09

Compugen Ltd. (CGEN)

Anchor BanCorp Wisconsin, Inc. (ABCW)

Active Power Inc. (ACPW)

Altus Pharmaceuticals Inc. (ALTU)

Cell Therapeutics, Inc. (CTIC)

Beazer Homes USA Inc. (BZH)

OTC & Pink Sheets Stocks to Watch - 6/24/09

Discuss these at http://stockstobuy.org

IDEAL FINANCIAL SOL (IFSL.PK)

SpongeTech Delivery Systems, Inc. (SPNG.OB)

LIGATT SECURITY INTE (LGTT.PK)

Redpoint Bio Corporation (RPBC.OB)

Advanced Cell Technology Inc. (ACTC.PK)

Cord Blood America Inc. (CBAI.OB)

MAGELLAN ENERGY NEW (MGLG.PK)

WINNING BRANDS CORP (WNBD.PK)

mPhase Technologies, Inc. (XDSL.OB)

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Discuss Stocks - www.stockstobuy.org

Stocks to Watch - 6/24/09 - Stock Market Ideas

Direxion Daily Financial Bear 3X Shares (FAZ)

Daily Finan. Bull 3X Shs(ETF)(FAS) - FAS stock broke $8 on Tuesday morning and quickly snapped back hard into the $8.40's in the afternoon hours. There is a lot of resistance in the $8.40's from Monday afternoon and Tuesday. When FAS break above $8.50 I think it could make an attempt to retest $9. I continue to buy the huge dips and sell the 4-6% bounce back rips higher. Banks will start reporting earnings in about three weeks and I expect some better then expected earnings reports due the borrowing at zero factor. As for FAZ, if FAS can get back near $10, I would be buying FAZ for a trade.

Citigroup Inc (C:NYSE) - Citigroup stock broke down through $3 on Tuesday for the first time since the start of May 2009. $2.90 ended up being the low before the snap back rally back to $3. This could have been the capitulation selling investors were looking for and C stock could be gearing up for a run back to $3.25-$3.50 before earnings. If I were buying Citigroup here, i'd be placing a stop loss order at $2.89.

Bank of America Corp ( BAC ) - Bank of America Corporation was very strong on Tuesday and traded back above $12 for most of the day. BAC has strong support at the 50 day moving average around $11.16 but a close below this would be the first sign of severe weakness. The stock has resistance at $12.75 ( 10 day moving average ) and $13.84 ( 200 day moving average ).

Wells Fargo & Company (NYSE:WFC) - Wells Fargo stock traded near Guy Adami's $22 price target on Tuesday and quickly bounced back up to $23. I am expecting another great earnings quarter out of WFC in the coming month. In my opinion, anything below $22 is a strong buy.

Potash Corp. of Saskatchewan (NYSE: POT) , Mosaic Co. (MOS) - POT and MOS snapped back Tuesday after a huge pullback as reports of weakening Potash demand were released last week. POT stock could be headed back to the $98-$100 resistance area in the short term which I would then sell. The 10 day moving average is getting ready to break down through the 50 day moving average....this is a bearish signal. If POT would retrace to the $80 support level, I will be buying!

Research In Motion Ltd. (RIMM) - RIMM was strong on Tuesday and traded back above $70 once again. The low was $67.53 so this is where i'd be putting my stop loss order if I were trading RIMM stock. I am neutral right now on shares of RIMM at $70, i'd be a buyer below $60, a seller in the $80's.

Ford Motor Company (F) - Ford traded down to $5.21 on Tuesday, almost near my buy price of $5. Each time we get these big dips, Ford stock always snaps back....very bullish. If the stock market rolls over one more time in the next few weeks I think you will be able to pick up shares around $5. This is what I am waiting for right now.

Hemispherx Biopharma, Inc. (HEB) - Shares of HEB were crushed on Tuesday morning as another big investor sold shares. The lack of an FDA decision or company press release explaining the situation has really unnerved investors who are holding the shares. Keep in mind, HEB stock is still up 100% from when all of this started back in May. I continue to have no position in the stock but am eagerly awaiting the FDA decision on Ampligen. If you are trading HEB, a break above $2.15 would probably get the stock moving higher again and you might be able to get $2.50 out of it in the short term.

Buy the Dip - Below is a list of stocks I would be buying on any strong pullback.

Visa Inc. (NYSE: V)

MasterCard (MA)

Apple (AAPL)

First Solar (FSLR)

McDonald's Corporation (MCD)

Continental Resources Inc. (CLR)

Hess Corp ( HES )

Freeport-McMoRan Copper & Gold Inc. (FCX)

Pyramid Oil Company ( PDO )

AgFeed Industries ( FEED )

Fuel Systems Solutions, Inc. (FSYS)

STEC, Inc. (STEC)

Huntington Bancshares Inc. (HBAN)

Other Stocks to Watch - June 24, 2009

Agilysys Inc. (AGYS)

Republic Airways Holdings Inc. (RJET)

La-Z-Boy Inc. (LZB)

GreenHunter Energy, Inc. (GRH)

America's Car-Mart Inc. (CRMT)

Lloyds Banking Group plc (LYG)

Hudson Highland Group Inc. (HHGP)

CB Richard Ellis Group, Inc. (CBG)

Navios Maritime Holdings Inc. (NM)

SIGA Technologies Inc. (SIGA)

Owens Corning (OC)

Penny Stocks to Watch - 6/24/09

Compugen Ltd. (CGEN)

Anchor BanCorp Wisconsin, Inc. (ABCW)

Active Power Inc. (ACPW)

Altus Pharmaceuticals Inc. (ALTU)

Cell Therapeutics, Inc. (CTIC)

Beazer Homes USA Inc. (BZH)

OTC & Pink Sheets Stocks to Watch - 6/24/09

Discuss these at http://stockstobuy.org

IDEAL FINANCIAL SOL (IFSL.PK)

SpongeTech Delivery Systems, Inc. (SPNG.OB)

LIGATT SECURITY INTE (LGTT.PK)

Redpoint Bio Corporation (RPBC.OB)

Advanced Cell Technology Inc. (ACTC.PK)

Cord Blood America Inc. (CBAI.OB)

MAGELLAN ENERGY NEW (MGLG.PK)

WINNING BRANDS CORP (WNBD.PK)

mPhase Technologies, Inc. (XDSL.OB)

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

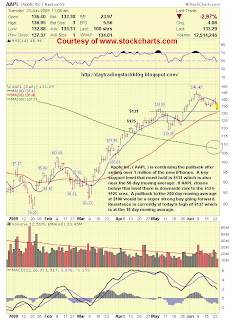

Apple AAPL Stock Analysis June 23, 2009

Apple AAPL Stock Chart - The following is technical analysis of Apple Inc ( NASDAQ:AAPL ) stock for June 23, 2009.

Apple AAPL Stock Chart - The following is technical analysis of Apple Inc ( NASDAQ:AAPL ) stock for June 23, 2009.Apple Support and Resistance Levels: 6/23/09

Resistance - $134, $137, $140

Support - $131, $125, $124, $120

http://stockcharts.com/ - Chart

Discuss Stocks - http://stockstobuy.org

Apple Inc, ( AAPL ) is continuing the pullback after selling over 1 million of the new iPhones. A key support level that must hold is $131 which is also near the 50 day moving average. If Apple closes below this level there is downside risk to the $124-$125 area. A pullback to the 200 day moving average at $108 would be a super strong buy going forward. Resistance is currently at today's high of $137 which is at the 10 day moving average. For More Technical Analysis - Go Here

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Biggest Stock Gainers 6/23/09 June 23, 2009

Today, June 23, 2009, there are several stock gainers that are breaking out with some nice momentum. If you are looking to day trade today, you might want to check out the following stocks. Check out today's biggest gainers and the Top Stocks for 2009. You can find yesterday's Top Gainers Report Right Here

Top Stocks 6/23/09 - Biggest Gainers Today

Discuss Stocks - www.stockstobuy.org

Compugen Ltd. (CGEN)

Republic Airways Holdings Inc. (RJET)

GreenHunter Energy, Inc. (GRH)

Hudson Highland Group Inc. (HHGP)

America's Car-Mart Inc. (CRMT)

Alvarion Ltd. (ALVR)

Navios Maritime Holdings Inc. (NM)

Sonic Corp. (SONC)

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Top Stocks 6/23/09 - Biggest Gainers Today

Discuss Stocks - www.stockstobuy.org

Compugen Ltd. (CGEN)

Republic Airways Holdings Inc. (RJET)

GreenHunter Energy, Inc. (GRH)

Hudson Highland Group Inc. (HHGP)

America's Car-Mart Inc. (CRMT)

Alvarion Ltd. (ALVR)

Navios Maritime Holdings Inc. (NM)

Sonic Corp. (SONC)

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Hot Penny Stocks 6/23/09 June 23, 2009

Today, 6/23/09, there are a few penny stock gainers breaking out to the upside. Be sure to check out the Top 2009 Penny Stock Gainers on the NYSE, Nasdaq, and AMEX. We tend to stay away from OTC and Pink Sheets stocks but we do list some on occasion. You can find ALL Penny Stock Reports Here

Penny Stock Gainers - June 23, 2009

Discuss Stocks - http://stockstobuy.org

Altus Pharmaceuticals Inc. (ALTU) - $0.45 Up 7% - No News

Beazer Homes USA Inc. (BZH) - $1.77 Up 7.27% - No News

Javelin Pharmaceuticals, Inc. (JAV) - $1.30 Up 9.24% - Javelin Pharmaceuticals Completes Open Label Safety Study of Dyloject

Vertro, Inc. (VTRO) - $0.21 Up 5.11% - No News

Active Power Inc. (ACPW) - $0.67 Up 8.10% - No News

Redpoint Bio Corporation (RPBC.OB) - $0.11 Up 57.14% - Redpoint Bio Identifies All-Natural Sweetness Enhancer For Use in Food and Beverages

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - Stock Message Board

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Penny Stock Gainers - June 23, 2009

Discuss Stocks - http://stockstobuy.org

Altus Pharmaceuticals Inc. (ALTU) - $0.45 Up 7% - No News

Beazer Homes USA Inc. (BZH) - $1.77 Up 7.27% - No News

Javelin Pharmaceuticals, Inc. (JAV) - $1.30 Up 9.24% - Javelin Pharmaceuticals Completes Open Label Safety Study of Dyloject

Vertro, Inc. (VTRO) - $0.21 Up 5.11% - No News

Active Power Inc. (ACPW) - $0.67 Up 8.10% - No News

Redpoint Bio Corporation (RPBC.OB) - $0.11 Up 57.14% - Redpoint Bio Identifies All-Natural Sweetness Enhancer For Use in Food and Beverages

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - Stock Message Board

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Visa V Stock Analysis June 23 2009 6/23/09

Visa V Stock Chart Analysis - The following is technical analysis for Visa Inc. (NYSE:V) stock for June 23, 2009.

Visa V Stock Chart Analysis - The following is technical analysis for Visa Inc. (NYSE:V) stock for June 23, 2009.Visa Support and Resistance Levels: 6/23/09

Resistance - $63, $64, $67

Support - $60, $58, $57, $52.50

Discuss Stocks - http://stockstobuy.org

We are finally getting that long awaited pullback in Visa stock. Support is currently located at $60 with downside to $57-$58 which would be a great buy. I would take an even bigger position if Visa ever got back between $50-$52.50. Visa is a strong company for the future and I would be buying on any huge pullbacks like we are seeing. For More Technical Analysis - Go Here

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Baltic Dry Index Shipping Rates 6/23/09 BDI

The BDI data is critical for how the DryBulk Shipping Stocks such as DryShips Inc ( DRYS ), Excel Maritime Carriers Ltd( EXM ), Diana Shipping Inc ( DSX ), Genco Shipping & Trading Limited ( GNK ), TBS International Limited ( TBSI ), Navios Maritime ( NM ), Eagle Bulk Shipping Inc. ( EGLE ), Paragon Shipping Inc. ( PRGN ), Star Bulk Carriers Corp. ( SBLK ), and OceanFreight Inc ( OCNF ) will trade during the day. As you probably know, the Dry Bulk Shipping index can tell you a lot about the state of the World Economy. When Bulk Shipping Rates are at all time highs, the World Economy is outstanding. When Bulk Shipping Rates are as low as they have been lately, it signifies that the world economy has come to a screeching halt!

http://dryindex.com - Discuss Stocks - http://stockstobuy.org

Dry Bulk Shipping Rates - June 23, 2009 - Down 3 Straight Days

Baltic Dry Index ( BDI ) - 3874 Down 155

Baltic Cape Index ( BCI ) - 7441 Down 468

Panamax Index ( BPI ) - 3021 Down 47

Supramax Index ( BSI ) - 1757 Down 1

Past Bulk Shipping

Discuss the Baltic Dry Index - Click Here

For More Stock Market Updates, visit , http://daytradingstockblog.blogspot.com/ or Subscribe for FREE

http://dryindex.com - Discuss Stocks - http://stockstobuy.org

Dry Bulk Shipping Rates - June 23, 2009 - Down 3 Straight Days

Baltic Dry Index ( BDI ) - 3874 Down 155

Baltic Cape Index ( BCI ) - 7441 Down 468

Panamax Index ( BPI ) - 3021 Down 47

Supramax Index ( BSI ) - 1757 Down 1

Past Bulk Shipping

Discuss the Baltic Dry Index - Click Here

For More Stock Market Updates, visit , http://daytradingstockblog.blogspot.com/ or Subscribe for FREE

FAS FAZ Stock Analysis June 23, 2009 6/23/09

The Direxion Daily Financial Bear 3X Shares (FAZ) & Daily Finan. Bull 3X Shs(ETF)(FAS) have been very active over the past six months. The following is technical analysis on Financial Bull ( FAS ) for 6/23/09. Knowing the support and resistance levels for FAS will help you trade FAZ.

The Direxion Daily Financial Bear 3X Shares (FAZ) & Daily Finan. Bull 3X Shs(ETF)(FAS) have been very active over the past six months. The following is technical analysis on Financial Bull ( FAS ) for 6/23/09. Knowing the support and resistance levels for FAS will help you trade FAZ.FAS Support and Resistance Levels - June 23, 2009

Resistance Levels: $8.60, $9.20, $10.00

Support Levels: $8.00, $7.88, $7

http://stockcharts.com - Chart

Discuss Stocks - http://stockstobuy.org

FAS stock is back testing the $8 support level once again. As you can see, this has been a major support level over the past 6 months and when broken, there is huge downside risk. FAS closed significantly below the 50 day moving average on June 22, a bearish sign. I am looking to buy FAS in the $7 range for a bounce trade but clearly the trend is now down. If FAS can close back above the 10 day moving average I would get more bullish but for now, buy and sell quickly.

If you think the banks will run into more problems and the market will sell them off, buy the FAZ when FAS gets back to the 10 day moving average. If the downtrend is solid, FAS will fail each time these moving averages are tested. I will personally be buying FAZ when FAS trades near $10. For More Technical Analysis - Go Here

Today's Biggest Stock Market Gainers - Top 2009 Stock Gainers - Top 2009 Penny Stocks - FAS/FAS Group Message Board

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Mortgage Rates Today 6/23/09 June 23, 2009

Housing Bottom? One of the things I watch for regarding a possible housing bottom are daily mortgage rates. Below is list of Today's Mortgage Rates out of Wells Fargo.

Loan Type - Interest Rate - APR - 6/23/09

30-Year Fixed 5.500% 5.697%

30-Year Fixed FHA 5.500% 6.245%

15-Year Fixed 5.000% 5.330%

5-Year ARM 4.625% 4.412%

5-Year ARM FHA 4.750% 3.925%

40-Year Fixed - N/A

Jumbo Loan Rates - APR

30-Year Fixed 6.375% 6.525%

5-Year ARM 5.125% 4.549%

For Previous Mortgage Rates - Click Here

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Loan Type - Interest Rate - APR - 6/23/09

30-Year Fixed 5.500% 5.697%

30-Year Fixed FHA 5.500% 6.245%

15-Year Fixed 5.000% 5.330%

5-Year ARM 4.625% 4.412%

5-Year ARM FHA 4.750% 3.925%

40-Year Fixed - N/A

Jumbo Loan Rates - APR

30-Year Fixed 6.375% 6.525%

5-Year ARM 5.125% 4.549%

For Previous Mortgage Rates - Click Here

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

1 and 3 Month Libor Rates - 6/23/09 - Today's Libor Rates

It seems as though everyone is watching Libor rates these days. Today's Libor Rates for 6/23/09, are: 1 Month Libor Rate - 0.314%. & 3 Month Libor Rate - 0.608%. The overnight Libor rate is 0.278%. As you can see, Libor Rates have changed today, June 23, 2009. The overnight libor rate went up while the 1 & 3 month libor rates went down.

Here are Previous Libor rates. You can also compare Libor Rates to how the Dow Jones traded.

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Here are Previous Libor rates. You can also compare Libor Rates to how the Dow Jones traded.

For the latest updates on the stock market, visit, http://daytradingstockblog.blogspot.com/ or Subscribe for Free

Subscribe to:

Comments (Atom)